Finance and Capital

Development Finance & Capital Introduction Across the Full Project Lifecycle

Façade Creations operates through a fully integrated project delivery model supporting complex construction projects from early-stage feasibility through to completion. Finance and Capital is structured as a development finance and capital introduction capability designed to unlock funding for entire construction projects – residential, commercial, mixed-use, and infrastructure – rather than isolated trade packages.

Across global markets, viable developments frequently stall despite strong fundamentals: land ownership, planning consent, technical viability, and market demand. The constraint is rarely the project itself, but access to appropriately structured capital. Our Finance and Capital service exists to solve this problem by introducing clients to suitable development finance partners, aligning capital with delivery strategy, and ensuring projects can progress from concept to completion.

We operate on a capital introduction and structuring model, providing access to a diversified network of independent capital partners. These include development finance providers, private credit institutions, real asset investors, and infrastructure-focused capital managers. Partner selection is driven by asset class, jurisdiction, project scale, risk profile, and delivery horizon – not by a single lender or predefined product.

Once funding is secured, Façade Creations remains closely aligned with project delivery, ensuring capital deployment, programme sequencing, and construction execution remain coordinated. Where façade works form part of the overall scheme, Façade Creations can deliver those elements within the same integrated framework.

Capital Integrated With Delivery – Not Treated in Isolation

Development finance is most effective when structured alongside the realities of construction. Our approach integrates capital considerations with programme, procurement, technical risk, and delivery sequencing from the outset.

We work alongside developers, landowners, investors, and project teams to ensure:

- Capital structures reflect real construction phasing and cost curves

- Funding drawdowns align with measurable delivery milestones

- Risk is allocated appropriately across the capital stack and delivery partners

- Funding conditions support – rather than restrict – programme certainty

This integrated alignment reduces fragmentation between finance and construction, mitigates execution risk, and improves overall project outcomes. Capital becomes an enabler of delivery rather than a late-stage constraint.

Core Principles of Our Development Finance Model

- Whole-Project Development Finance: Capital structured to support the full lifecycle of construction projects, from pre-development through build and completion.

- Capital Introduction, Not Lending: We introduce and structure capital through independent institutions without acting as a direct lender or named financial adviser.

- Multi-Partner Access: Projects are matched with the most suitable capital partners rather than forced into a single funding route.

- Jurisdiction-Aware Structuring: Funding approaches adapted to local legal, regulatory, and market frameworks across international regions.

- Delivery-Aligned Capital: Finance structured around programme logic, procurement strategy, and execution risk.

Why Development Finance Is Critical

Construction and infrastructure projects are inherently capital-intensive, front-loaded, and exposed to timing risk. Even well-capitalised sponsors face constraints when multiple projects run concurrently.

Common Market Challenges

- Land-Rich, Capital-Constrained Developers: Ownership or control of land and planning approvals without sufficient equity or senior funding to mobilise construction.

- High Upfront Costs: Early-stage expenditure on design, enabling works, approvals, procurement, and mobilisation occurs long before income generation.

- Complex Capital Stacks: Projects frequently require layered funding structures combining equity, senior debt, mezzanine, or alternative capital.

- Extended Delivery Horizons: Long construction programmes tie up capital and limit sponsors’ ability to pursue parallel developments.

- Infrastructure Funding Gaps: Public and private infrastructure schemes often face misalignment between budget cycles and immediate delivery requirements.

The Role of Development Finance

Well-structured development finance:

- Unlocks stalled or delayed projects

- Enables early mobilisation and programme certainty

- Preserves sponsor liquidity and balance-sheet flexibility

- Supports phased and large-scale developments

- Facilitates infrastructure delivery where funding release timing is critical

Our Capital Partner Ecosystem

Rather than relying on a single funding source, we introduce clients to a broad ecosystem of independent capital partners, including:

- Development finance institutions

- Residential and commercial real estate capital providers

- Infrastructure and real-asset-focused investment managers

- Private credit and alternative lending platforms

Capital partners are selected based on project fundamentals, jurisdictional requirements, asset class, and delivery complexity. This approach mirrors established global development finance models used across mature and emerging construction markets.

Our role extends beyond introduction. We remain actively involved through financial close and into delivery, ensuring capital deployment remains aligned with project execution.

How Development Finance Works

- Project & Viability Review

Assessment of site conditions, planning status, delivery strategy, cost plan, and funding requirements. - Capital Structuring & Partner Matching

Development of an appropriate capital structure and introduction to suitable independent capital partners. - Due Diligence & Financial Close

Coordination of technical, commercial, and legal inputs to achieve efficient funding approval and close. - Construction & Capital Deployment

Funding released against agreed milestones, aligned with programme progress and cost certification. - Completion, Exit or Refinance

Capital repaid or refinanced in line with the agreed development and investment strategy.

Client Benefits

- Project Activation: Move from land and planning to active construction.

- Funding Certainty: Capital structured around delivery realities rather than theoretical models.

- Reduced Complexity: A single coordinated route between capital partners and construction delivery.

- Scalable Growth: Ability to progress multiple developments without overextending internal capital.

- Optional Integrated Delivery: Where relevant, Façade Creations can deliver façade works within the same project framework.

Typical Development Finance Use Cases

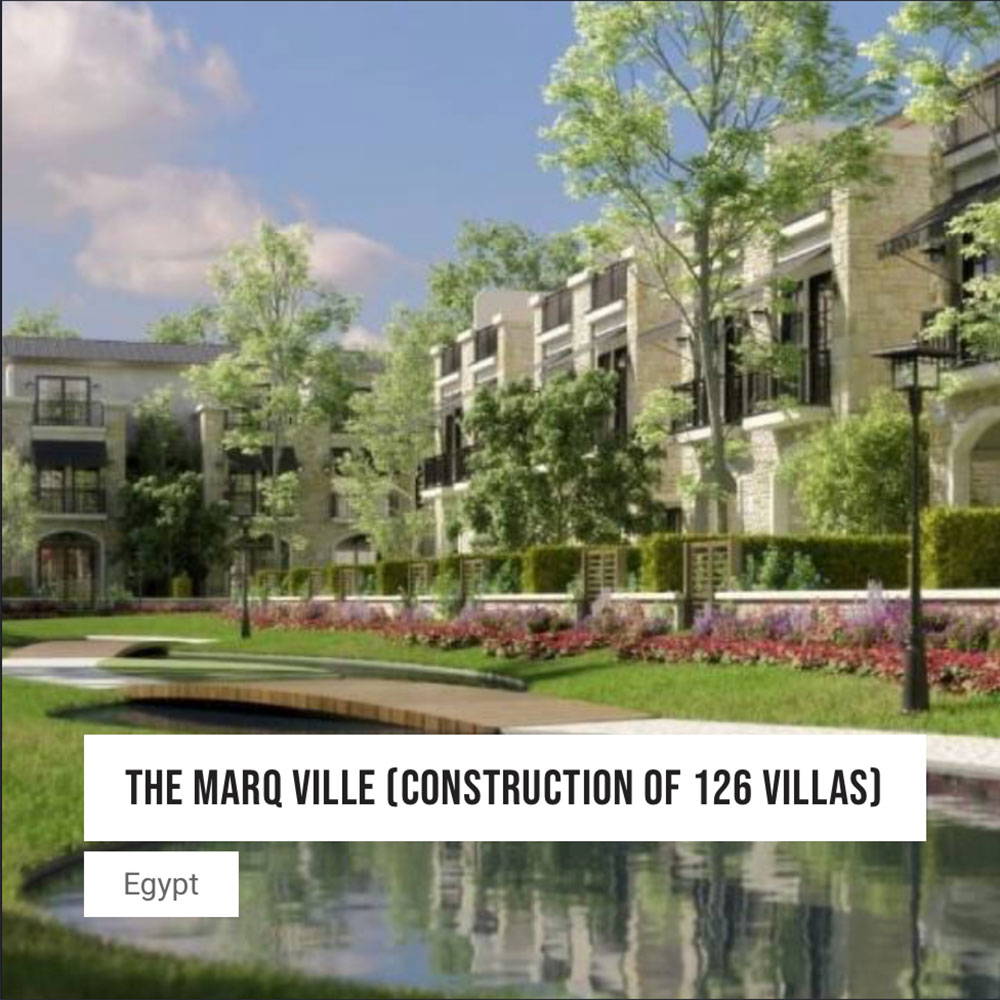

- Residential Projects: Low-rise, high-density, and mixed-use residential schemes.

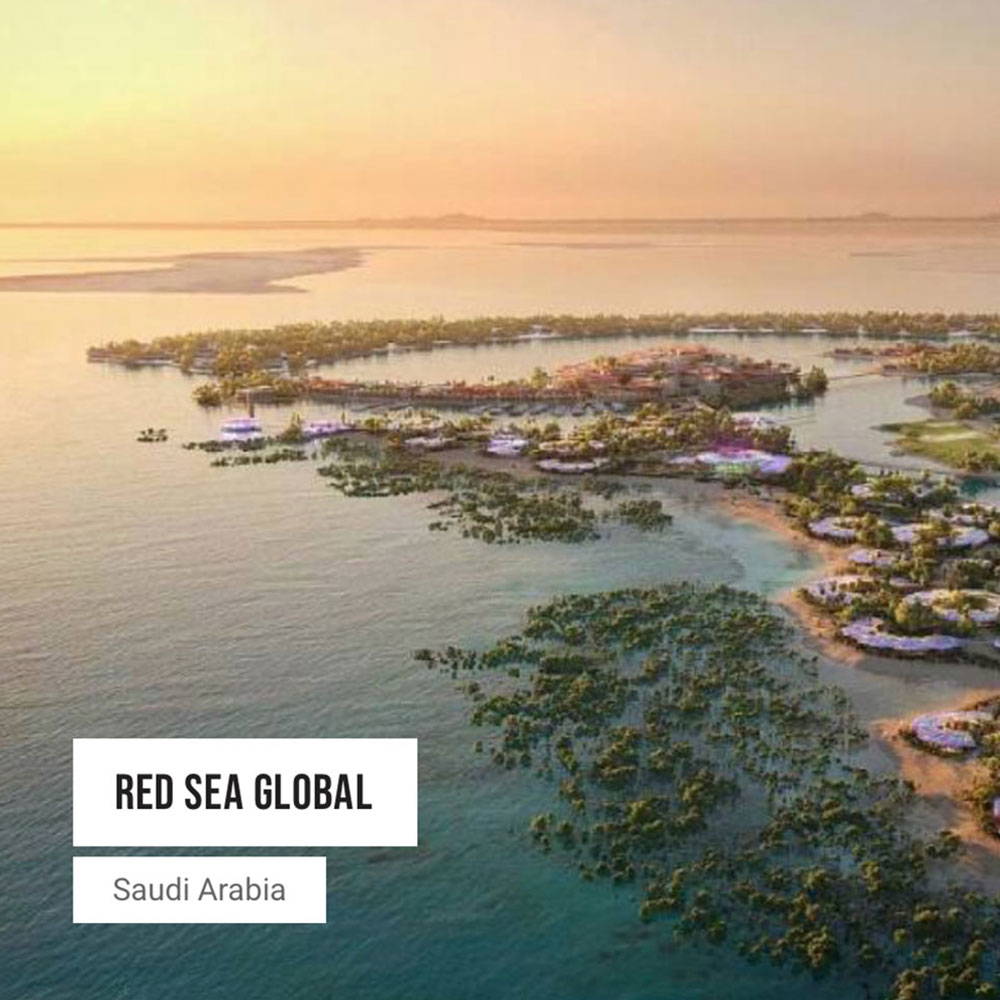

- Commercial Developments: Office, retail, hospitality, and large commercial assets.

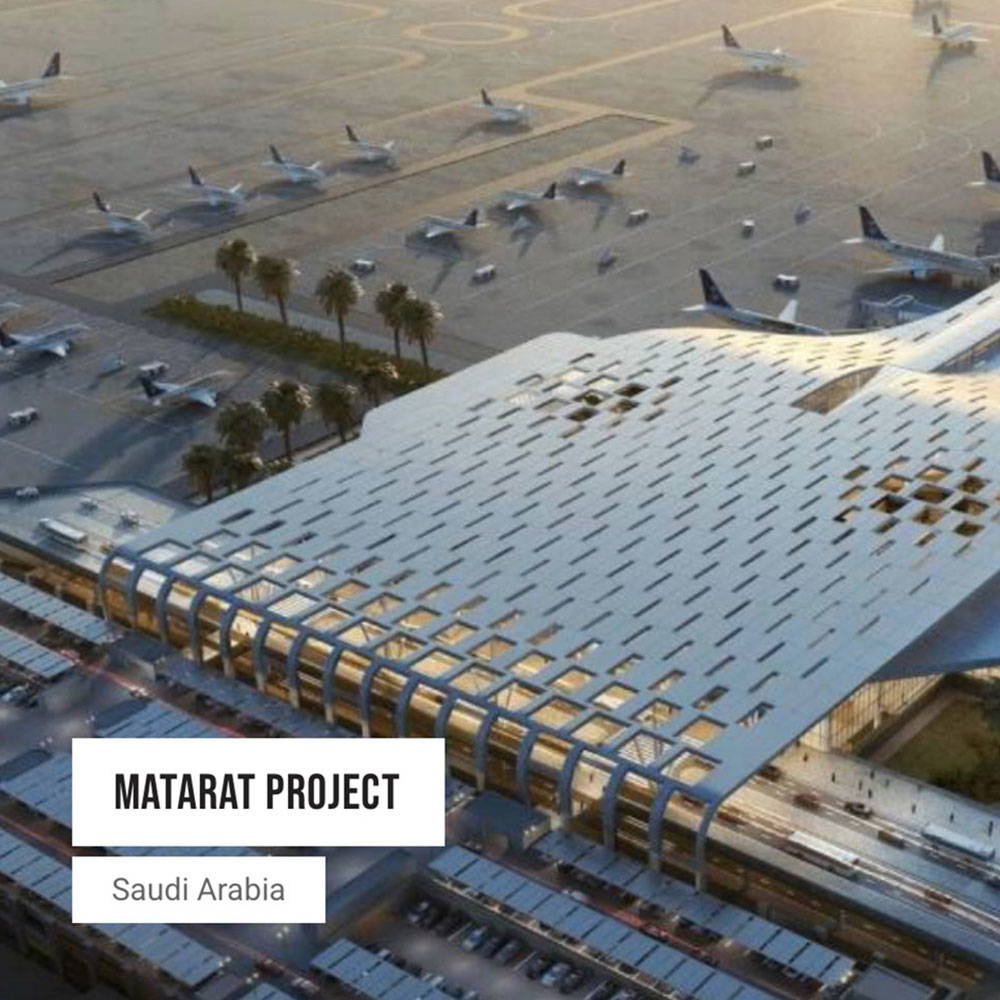

- Infrastructure & Public Realm: Transport, education, healthcare, utilities, and civic projects.

- Phased Masterplans: Large-scale developments requiring flexible, milestone-based funding.

Engage Our Finance & Capital Team

If access to capital is the barrier between your project and delivery, our Finance and Capital capability provides a clear, structured route forward – aligning development finance with execution across the full project lifecycle.

Request a Confidential Development Finance Discussion

Contact Our Project Team